Unlock Real Estate Wealth: 4 Friends, 1 Plan smart investment in Real estate Hyderabad

Pooling home loan eligibility with friends is a smart way to enter Hyderabad’s booming real estate hyderabad market. Four friends can jointly secure home loans, buy multiple apartments, an split rental income or profits. Turn friendship into financial growth. Why wait?

WEALTH-BUILDING WITH NETWORK

Realty For You

4/15/20251 min read

🧱 Step-by-Step Plan

1. Form a Legal Entity (Optional but Recommended)

To simplify ownership and legal clarity:

Option A: Co-own as Individuals – Each person appears as co-owner in sale deed and co-borrower in the loan.

Option B: Register a Partnership/LLP/Private Ltd – The entity owns the property. The group contributes capital or personal loan to the entity.

Tip: Start with Option A for a first investment unless you're building a long-term portfolio.

💰 2. Combine Loan Eligibility

Each friend can typically get ₹50–80 Lakhs loan (depending on income, age, credit score). So together:

Loan power = ₹2–3 Cr

Add your down payment (20–30%) — say ₹50 Lakhs total.

Total budget = ₹2.5–3.5 Cr

🏢 3. What You Can Buy in Hyderabad for ₹2.5–3.5 Cr

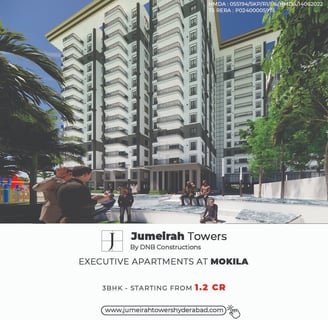

Under-construction 2–3 apartments in promising areas like:

Mokila, Kolluru, Pati, Bachupally (mid to premium)

Kompally, Tukkuguda, Patencheru (affordable)

Or 1 premium 3BHK in a high-growth zone - Kokapet, Financial District

Or invest in a builder floor / small standalone building with 3–5 units for rental income + resale later

📈 4. Strategy Options

Buy & Hold (Rental Income) - Rent out to families or professionals for 3–4% rental yield, 8–12% appreciation

Flip (Buy Under-Construction, Sell at Possession) - Book early, sell before registration for 20–30% ROI in 18–36 months

🏦 5. Loan Structuring

Co-borrower Loan: All 4 friends become co-borrowers and co-owners. EMI responsibility is shared.

Legal Agreement: A MoU or partnership agreement defining:

Who pays how much

What happens if one wants to exit

Exit strategy, rental share, etc.

⚖️ 6. Legal & Tax Tips

Create a notarised agreement or registered partnership deed

Decide exit options clearly (buyout, resale, etc.)

Rental income will be taxed as per individual share

Capital gains tax applies on sale – plan for minimum 2 years holding to avail LTCG benefit (20% tax with indexation)

🚀 7. Bonus Tip: Invest in Pre-Launch Projects

You can negotiate

Lower price per sq.ft.

Flexible payment plans

Exclusive units with higher resale value